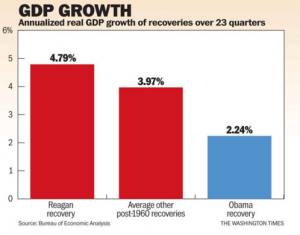

The US economy’s recovery from the 2008 recession was historically weak, as shown in this chart from the Washington Times.

In an article that followed an address earlier this month where the President boasted about employment numbers, the New York Post summarized the situation this way:

From his Jan. 20, 2009, inauguration until last month that figure has fallen from 7.8 percent to 4.9 — down 37.2 percent. But:

- The labor force participation rate over that period has slid from 65.7 percent to 62.9 (the lowest reading since March 1978) — down 4.3 percent.

- On Obama’s watch, the percentage of Americans below the poverty line has grown, according to the most recent Census data, from 14.3 percent to 14.8 percent in 2014 — up 3.5 percent.

- Real median household income across that interval sank from $54,925 to $53,657 — down 2.3 percent.

- Food Stamp participants soared in that time frame from 32,889,000 to 45,874,000 — up 39.5 percent.

- Meanwhile, from Obama’s arrival through the fourth quarter of 2015, the percentage of Americans who own homes sagged from 67.3 percent to 63.8 — down 5.2 percent.

The Orange County Register wrote “the economic recovery that began in 2009 is the weakest during the post-World War II era…Real per-capita growth in disposable income since the so-called Great Recession ended in 2009 is not even a third of what it was during the previous four economic expansions. And job creation during the Obama recovery is worse than during all but one postwar recovery.”

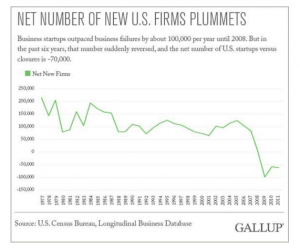

The rate of new business creation has plummeted. An article by Jim Clifton, Chairman and CEO of Gallup reported as follows: “The U.S. Census Bureau reports that the total number of new business startups and business closures per year — the birth and death rates of American companies — have crossed for the first time since the measurement began.” His article included the following chart that shows the drop in formation of new businesses.

The government pays people to NOT work, and the ways it does that and the dollars spent doing it grow and grow. The US now has the highest business tax rates in the world; and government regulation has grown out of hand. Voters are worried. Exit polling in the New Hampshire primary showed that 79% of Democrats were either ‘somewhat’ or ‘very’ worried about the economy; for Republicans it was 93%.

Stimulus

The two main tools of economic management are monetary and fiscal policy. President Obama has used both tools to try and stimulate the economy. On the fiscal side there was a $787 billion stimulus spending package (remember ‘shovel ready’?) passed early in 2009. On the monetary side the Obama administration used bond-buying programs (remember QE1, QE2 and QE3?) to push $3.7 trillion of cash into the market, and has held interest rates down – the current Federal funds rate is one half per cent.

The administration also had the benefit of lower energy prices. A story in the New York Times had experts predicting a boost of a half percent of economic growth and $70 billion in annual consumer spending. All with very little result. The administration has painted itself into a corner. There is nowhere left to go with stimulus. The tank is dry.

Cut Taxes and Deregulate

The economy needs tax and regulatory reform. Calls for tax reform come from both of the major parties. The US has the highest corporate tax rate in the industrialized world. There is also a problem with regulation strangling businesses.

The World Bank ranks business climate across countries using different indices. One of these is “ease of starting a business”, a factor largely driven by regulation. The index includes 189 countries — they apparently left out four of the 193 member states in the UN. The US ranks 49th on ‘ease of starting a business’ behind Burundi, Afghanistan, and the Ukraine.

The Competitive Enterprise Institute does an annual survey of Federal regulations and found the following: “Federal regulation and intervention cost American consumers and businesses an estimated $1.88 trillion in 2014 in lost economic productivity and higher prices…In 2014, agencies issued 16 new regulations for every law—that’s 3,554 new regulations compared to 224 new laws.”

Regulation is a battle of a thousand cuts. Three examples from the Wall Street Journal’s editorial pages:

- On 2/2/16, a former Labor Dept chief economist estimated the cost of one deceptively innocuous new requirement at “between $7.5 billion and $10.5 billion in the first year, and between $4.3 billion and $6.5 billion in future years”.

- In an 11/14/15 editorial a Florida economic development official estimated the cost of a new overtime requirement, for his state alone, at $1.7 billion in 2016.

- A 3/3/16 editorial called out the impact on broadband investment of the FCC’s new Internet regulations: capital expenditures by Internet service providers rose 8.7% in 2013. They rose by less than half that in 2014 as the new rules were considered. Then the rules were applied, and in 2015 capital expenditures dropped again – to a negative .4%.

Bottom Line

He has erected a multitude of New Offices, and sent hither swarms of Officers to harrass our people, and eat out their substance.

The Declaration of Independence, 1776

The Obama administration has tried fiscal and monetary stimulus over and over. You can’t accuse the President of being a pragmatist: he has an idea, he sticks to it regardless of success or failure.

Stimulus has failed. The economic data shows it, and exit polls show that voters feel it in their gut.

Deregulation and tax reform are both overdue. Somehow, Congress needs to take hold of the Federal rule-making mechanism. They can start by repealing the Davis-Bacon Act.