The recent talk about Federal tax cuts once again prompted misleading statements about the relationships between tax rates, revenues, and the deficit. The connection between these things is not clear cut. In some cases (revenues and deficits) we’re comparing apples and oranges. In some cases (revenue increases and decreases) we could profitably ask “compared to what?”

Some quotes from a panel discussion carried by NPR are typical:

a tax cut of the magnitude being talked about would reduce the money flowing into government coffers by $1.4 trillion over the next decade… It’s just pure sales job, smokescreen, fairy dust. … there’s no evidence tax cuts have ever paid for themselves

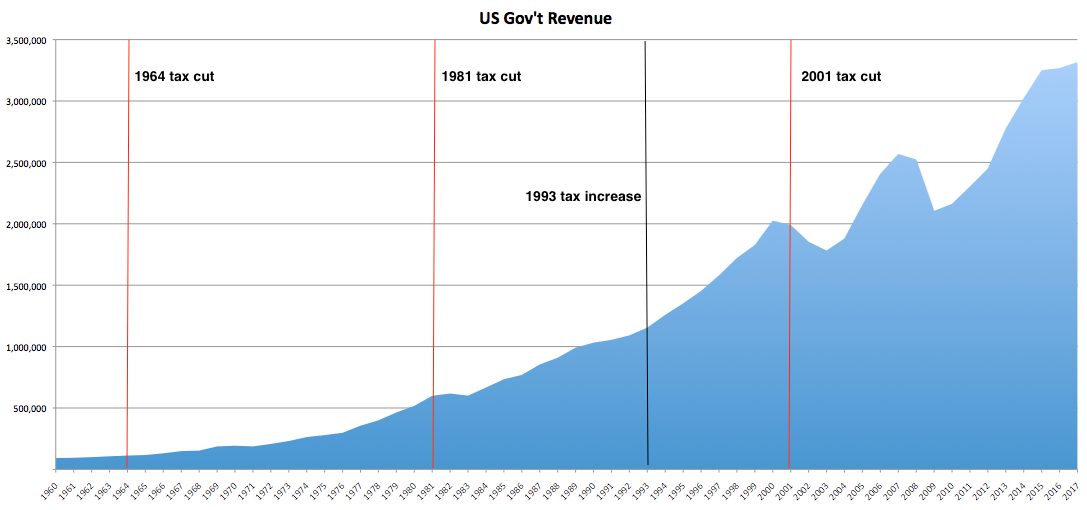

The speakers above are questioning whether tax cuts increase or decrease revenue. It might help to look at actual revenue numbers over a time span in which tax rates were both increased and decreased. Here is a chart, using data from the Office of Management and Budget.

The chart shows annual US government revenue from 1960 through 2017, with red lines indicating the Kennedy (1964), Reagan (1981) and Bush (2001) tax cuts. Also note the black line that marks the Clinton tax increase. I see no clear relationship between revenue, and tax cuts and increases:

- No visible increase in revenue growth following the Clinton tax increase.

- Brief halts in revenue growth after two of the three tax cuts (one year after the Reagan cut, two years after the Bush cut). The biggest drop in revenue comes after the 2008 crash – no connection to any tax cut. And take a second look at the other revenue drop: was that caused by the tax cut, or the 2000-2002 Dot Com Crash?

THE BOTTOM LINE

Three tax cuts over a span of 57 years. Revenue dropped following two of the three cuts, but only briefly. It’s hard to make a case that tax cuts hurt revenue growth. Also, I wonder where the evidence is that raising rates will increase revenue?