There’s been concern in Europe and the US over the last year or so about tax avoidance. The controversy has involved on the one hand US corporate darlings Starbucks, Google, and Amazon in a flap over tax payments in Europe; and on the other hand the Panama Papers and UK Prime Minister David Cameron.

Let me stipulate at the beginning that paying the taxes we owe is an obligation, both legal and moral. As the famed jurist Oliver Wendell Holmes said: “Taxes are what we pay for civilized society.”

Understand that tax avoidance is not the same thing as tax evasion. Tax evasion is illegal. The IRS provides a helpful web page with a quiz to make the differences clear. The quiz lists six activities. You decide whether it’s tax evasion or tax avoidance, and get graded on your answers. Again, evasion is illegal, avoidance is legal. Scanning the listed activities, the key distinction seems to be whether or not report income is reported:

1) Keeping a log of business expenses (Tax Avoidance )

2) Ignoring earnings from lawn mowing (Tax Evasion)

3) Not reporting interest earned on savings account (Tax Evasion)

4) Keeping a log of contributions to charity (Tax Avoidance)

5) Not reporting tips (Tax Evasion)

6) Claiming your dependents as tax deductions (Tax Avoidance)

Back to Google, Starbucks, Amazon and David Cameron…what they’re guilty of must be tax avoidance, because nobody’s going to jail. At worst, Google was fined $43 million in Turkey. Nobody denies tax avoidance occurred, but is this good or bad? The liberal journal The American Prospect calls out tax avoidance as a bad thing: “You pay more because elites use their influence to pay less.”

The tax avoidance tactic that has drawn most attention overseas is ‘profit-shifting’: corporations exploiting mismatches between various countries’ tax laws, moving their revenues from country to country to find the highest profits.

So what’s the harm? Indeed, if you’re a business and don’t conscientiously practice tax avoidance, you will probably find yourself the loser. Are corporations supposed to voluntarily refrain from profit-shifting and other tax avoidance tactics? Should they volunteer to pay a certain amount in excess of the tax they owe? And what if the business that doesn’t use tax avoidance then loses money, and has to lay off staff to stay afloat?

Let’s imagine how this might work: fictional Alpha Corp forgoes certain legal tax avoidance schemes. When the next quarter’s results come out we see Alpha Corp getting its bell rung. Suddenly its competitors are pulling ahead in revenue, getting improved access to financing. Alpha Corp’s stock price lags behind its competitors. When earning goals are missed, executives and managers lose pay raises and stock options. Costs are cut to maintain profits, requiring staff cuts and facility closures. Then one day, a whistleblower reveals that Alpha Corp’s CEO in a burst of civic charity forbade use of tax avoidance techniques that are standard across the industry. Stockholders revolt. The board insists they were kept in the dark. Within weeks, Alpha Corp has a new CEO who promises to restore their competitive position in the industry, and make full use of standard finance and accounting strategies to help Alpha Corp lower tax costs.

The moral of this story? If a business doesn’t push the law to its limit, it’s playing with one hand tied behind its back and betraying employees and investors.

Do corporations really have a moral obligation to pay extra tax? If so then how should we react to the tax avoidance schemes practiced by some prominent liberals:

- John Kerry, when he was a Senator from Massachusetts, domiciled his new yacht in Rhode Island, rather than his home state. By avoiding Massachusetts taxes Kerry saved himself over $500,000.

- George Lucas sold his film company to Disney in late 2012, avoiding anticipated capital gains tax increases and Obamacare surtaxes on investment income. The capital gains savings alone were $200 million.

- Andre ‘Dr Dre’ Young is a big Obama supporter and was the highest-paid musician in the world in 2012. The Irish Examiner reported that Dr Dre “has based three of his companies in one of the region’s best-known towns to avail of Ireland’s generous corporate tax rate, thereby reducing his tax liability.”

- Jack Lew, Obama’s Treasury Secretary invested personal funds in a Cayman Islands investment fund, and was an executive vice president at NYU when they placed investments in the Cayman Islands.

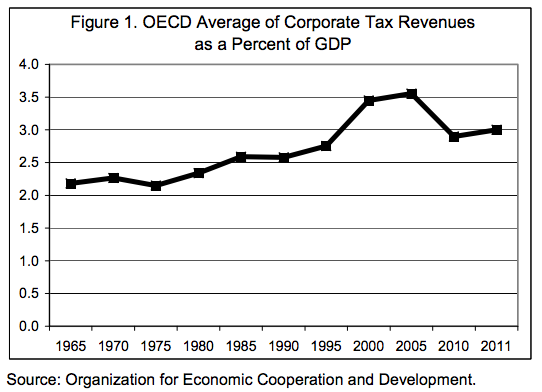

If there is a particular kind of tax avoidance you don’t like, make it illegal. It is unreasonable to criticize corporations for making every legal effort to succeed in the marketplace; it would be reasonable to criticize if they weren’t. Importantly, there is no obvious harm from corporate tax avoidance. Tax payments from corporations as a share of GDP are rising, not falling. The following chart is copied from cato.org.

If governments are really interested in collecting more revenue, then they should follow pro-growth economic policies – avoid high corporate taxes. An OECD study compared tax structures and found this: “Corporate taxes are found to be most harmful for growth, followed by personal income taxes, and then consumption taxes.”

As for the morality, tax avoidance is just fine. There is no obligation to pay extra tax. For a business, tax avoidance is responsible behavior. For the individual, it’s your money and your choice.

Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more…There is no such thing as public money; there is only taxpayers’ money.

Margaret Thatcher

It’s a good thing that governments are forced to compete in offering investment-friendly or business-friendly tax schemes, and it’s entirely sensible for businesses and individuals to move their money where it gets the best returns. As long as it’s legal.

Bottom Line

Tax avoidance is both moral and sensible. For businesses it’s a competitive requirement. The right thing to do is fulfill your legal responsibilities while delivering more profit than the competition. In order to fulfill responsibilities to investors, employees, and customers, as long as tax avoidance is available as a cost-cutting strategy it must be used.

For individuals, remember that it’s your money. If you choose to not use tax avoidance, then you will pay more tax than required. It would be like donating money to a charity, just know that it’s a very badly run charity.